The Greatest Guide To Tax Consultant Vancouver

Wiki Article

Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver Revealed

Table of ContentsOutsourced Cfo Services for BeginnersGet This Report about Cfo Company VancouverThe Of Outsourced Cfo ServicesAll About Outsourced Cfo Services

Not just will keeping cool documents and also records help you do your job more successfully and accurately, however it will certainly additionally send out a message to your employer and customers that they can trust you to capably manage their monetary details with respect as well as stability. Recognizing the numerous tasks you carry your plate, understanding the due date for every, and also prioritizing your time appropriately will make you a remarkable asset to your company.

Whether you maintain an in-depth calendar, set up normal pointers on your phone, or have a day-to-day order of business, remain in cost of your timetable. Keep in mind to continue to be versatile, nonetheless, for those urgent requests that are tossed your method. Just reconfigure your top priorities so you stay on track. Also if you like to hide with the numbers, there's no obtaining around the truth that you will be needed to connect in a range of methods with associates, managers, clients, and also industry professionals.

Also sending out well-crafted emails is an essential skill. If this is not your strength, it may be well worth your time as well as effort to get some training to boost your value to a potential employer. The accountancy area is one that experiences routine change, whether it be in policies, tax obligation codes, software, or finest methods.

You'll find out critical believing skills to help determine the long-term goals of a company (and also create plans to achieve them). Review on to uncover what you'll be able do with an audit degree.

The Basic Principles Of Cfo Company Vancouver

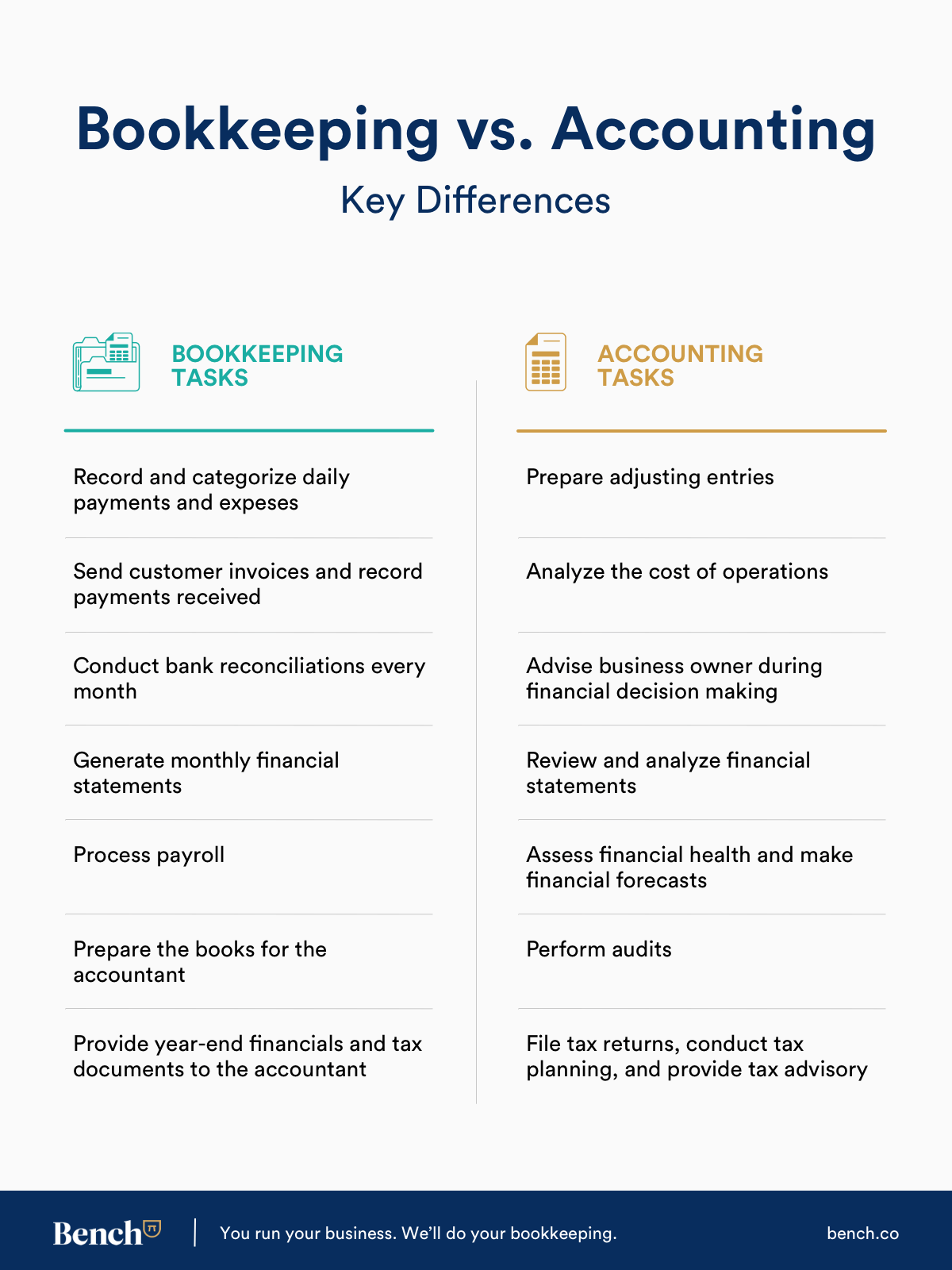

Just how a lot do accountants as well as accountants charge for their solutions? Exactly how a lot do bookkeepers and also accounting professionals charge for their solutions?To recognize rates, it's useful to recognize the distinction between accounting as well as bookkeeping. These two terms are typically made use of interchangeably, but there is a significant distinction in between bookkeeping as well as accounting solutions. We have created in detail about, however the extremely basic function of a bookkeeper is to record the purchases of a service in a regular way.

Under the conventional method, you won't recognize the amount of your costs until the job is total as well as the service provider has actually added up all of the minutes spent working with your documents. Although this is a typical pricing technique, we discover a couple of points wrong with it: - It develops a circumstance where clients feel that they shouldn't ask inquiries or gain from their accountants as well as accountants due to the fact that they will you can check here certainly get on the clock as quickly as the phone is addressed.

Cfo Company Vancouver Fundamentals Explained

If you're not satisfied after completing the training course, simply reach out and we'll provide a complete refund with no concerns asked. Currently that we've explained why we do not like the standard version, allow's look at just how we value our solutions at Avalon.

we can be readily available to assist with bookkeeping as well as bookkeeping questions throughout the year. - we prepare your year-end monetary declarations as well as tax obligation return (tax accountant in Vancouver, BC). - we're below to aid with questions as well as guidance as needed Equipment setup and also one-on-one bookkeeping training - Annual year-end tax filings - Guidance with concerns as required - We see a whole lot of small businesses that have annual profits between $200k and $350k, that have 1 or 2 staff members and also are owner took care of.

- we established up your cloud accounting system and teach you just how to send records online as well as view records. - we cover the price of the bookkeeping software application.

The smart Trick of Small Business Accountant Vancouver That Nobody is Discussing

We're likewise available to address questions as they show up. $1,500 for audit as well as pay-roll systems arrangement (single price)From $800 monthly (includes software application charges and also year-end expenses billed month-to-month) As organizations expand, there is frequently an in-between dimension where they are not yet large enough to have their very own inner money department however are complicated sufficient that simply hiring an accountant on Craigslist will not cut it.Report this wiki page